Discount Received Journal Entry

05022018 The amount payable to Mr. This 210 net 30 means.

Purchase Discount In Accounting Double Entry Bookkeeping

1 - Business started.

. Cash Ac Dr. 6000 subject to 10 trade discount by cash. In this case if the customer takes the discount by making early payment on the credit purchase the company needs to account for the sale discount with a proper journal entry.

Likewise the credit term is usually stated on the sale invoice with the specification of discount percentage and the time period it offers eg. The cost of the machinery destroyed by the flood was 12000 and it has accumulated depreciation of 6000. Its important for testing and exams to make sure you not only answer questions correctly but also complete them at the right speed.

However the insurance company only agreed to pay 5000The journal entry for this transaction will be as. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell. This means that the outstanding value of common stock and the asset received are at the same value.

Answer this pls - Journals Ledger Accounts Trial Balance Profit Loss Balance Sheet by. The Percentage of discount received and the total amount payable is given. Purchased from Kareem goods of list price of Rs.

In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire sum in advance for example security deposit to rent a property customized items bulk orders insurance premium etc. Visit the post for more. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

210 net 30 or 210 n30. Since IAP has already incurred various expenses called the cost of goods sold Cost Of Goods Sold The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct. Grab a pen and piece of paper and time yourself while attempting this exercise.

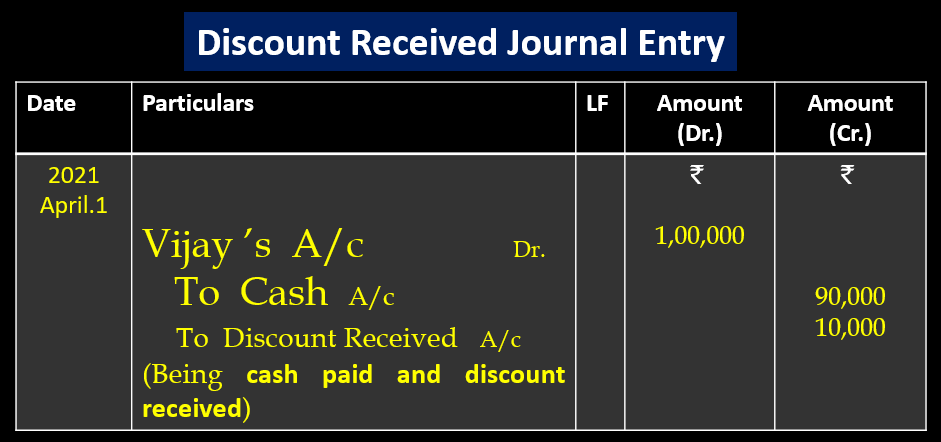

Distributed goods worth Rs. Further examples of compound journals can be seen at our double. Likewise this purchase discount is also called cash discount and the company needs to properly make journal entry for it when it receives this discount after making payment.

Different Journal Entry MCQs are here multiple-choice questions based on golden rules of debit and credit and format of journal entry. When a corporation issues common stock at par value the amount of cash or non-cash assets received equal to the value of the common stock. Eg The Indian Auto Parts IAP Ltd sold some truck parts to Mr.

Anonymous 2017 October 1 Started business with 50000 deposited in bank October 4 Purchased delivery van for 18000 paying by cheque October 5 Bought office equipment on credit from Elvis Ltd for 8000 October 8 Paid for advertising 540 cheque October 11. 800 and cash sales of Rs. As per the above journal entry debiting the Cash Account by 300000 means an increase in Cash Account by the same amount.

Journal Entries for Accounting Receivable. To Accounts Receivable Cr. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable ie invoices to a third party called a factor at a discount.

For example suppose a business provides design services and has received cash of 4000 from a customer. A of Rs 1000- and he allowed a discount 10. 210 net 30 or 210 n30.

An insurance claim amounted to 6000 was filed. A customer can purchase on two grounds. Intermediate -- Advanced Time limit.

1 st January 2017 Saeed Ahmad started business other transactions for the month of June as follows. 200 as free samples and goods taken away by the proprietor for. As a result journal entry for advance received from a customer is.

Journal Entry for Advance Received from a Customer. The credit term usually specifies the amount of discount together with the time period it offers eg. Record the journal entries for the following.

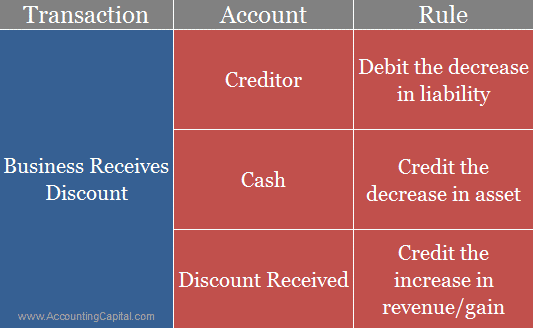

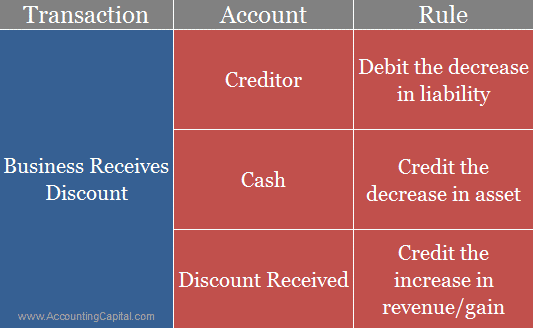

The journal entry at the time cash is received for goods sold on credit would be as follows. In this journal entry there are three accounts involved cash accounts payable and discount received and the transaction has one debit entry and two credit entries. Explanation of rules applied to Journal entry Journal entry 2.

In order to understand clearly this lets see the illustration of the journal entry for this kind of issuance of common stock. -This question was submitted by a user and answered by a volunteer of our choice. Both Journal Entry for Discount Received are the same and treated as the following.

A received cash on account journal entry is needed when a business has received cash from a customer and the amount is not allocated to a particular customer invoice or the customer has not yet been invoiced. The cash receipt needs to be. Likewise crediting Accounts Receivable by 300000 means a.

Sold goods to Din Muhammad Rs. Cash or creditIn the case of a cash purchase the payment is made immediately by the customer however in the case of a credit purchase the payment is expected to be made in the future as per the agreement. Suppose that there is an asset subjected to accumulated depreciation is destroyed by the flood.

Received Cash On Account Journal Entry Double Entry Bookkeeping Double Entry Journal Accounting Journal Template

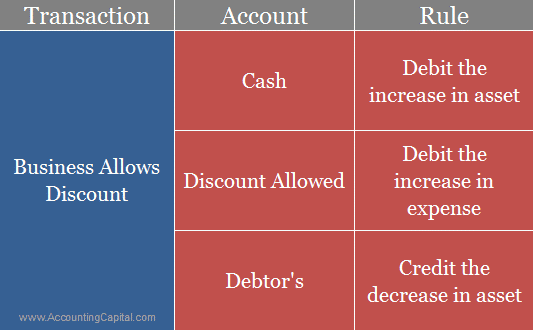

What Is The Journal Entry For Discount Allowed Accounting Capital

What Is The Journal Entry For Discount Received Accounting Capital

No comments for "Discount Received Journal Entry"

Post a Comment